Are You Paying Too Much? The Real Cost of Overlooked Home and Auto Insurance Savings

The reality is, insurance premiums can chew through your monthly budget if you don’t know the secrets the pros use. As costs for auto repairs, home materials, and even everyday living rise, many Americans are searching for the most affordable home and auto insurance options—yet too often, homeowners and drivers accept their renewal notice without question. But why should anyone pay more for coverage than absolutely necessary? Are there steps you could take right now that might put hundreds of dollars a year back into your pocket—without sacrificing the peace of mind that insurance is supposed to deliver?

The key isn’t just to find “cheap” coverage. It’s about understanding your real needs, the options available, and the small tweaks that can make a big impact on your premiums. With so much advertising noise and dozens of policy types, choosing the right level of protection can feel overwhelming. But smart insurance decisions don’t have to be complicated—and the costs of getting it wrong range from overspending to being exposed in a crisis. This article gives you clear, actionable guidance to cut through confusion, offering tips, expert insights, and grounded facts that will empower you to rethink your coverage, identify savings, and get the most value for your home and auto insurance.

Understanding Insurance: Why Affordable Coverage Matters More Than Ever

Affordable home and auto insurance isn’t just about slashing costs or picking the lowest-priced option. It’s about aligning your coverage with your actual risks, your assets, and your lifestyle. Too many people are either “insurance poor”—paying for extras they’ll never need—or dangerously underinsured, risking massive financial fallout if disaster strikes. Insurance protects your most valuable investments: your home provides shelter and stability, your vehicle is key to your daily life and work. A thorough understanding of coverage types, policy limits, and premium drivers makes it possible to protect both with confidence and efficiency.

Not knowing the basics of affordable home and auto insurance can have consequences well beyond your wallet. It can mean missing out on discounts you already qualify for, failing to update policies as your needs change, or facing hard lessons in the aftermath of an accident or disaster. Consider the shifting market today: with repair costs and natural disasters on the rise, rates may increase, but strategic choices let you control your financial exposure. Whether you’re renewing after years of loyalty to one provider or shopping coverage as you move to a new state, knowledge is your strongest asset in navigating affordability.

How Smart Insurance Choices Impact Your Lifestyle, Finances, and Peace of Mind

Approaching home and auto insurance with a strategic mindset—rather than as a fixed, unavoidable bill—unlocks substantial benefits. For example, understanding multi-policy discounts, adjusting deductibles, or choosing relevant add-ons can mean healthier finances each month and the confidence that comes from knowing your most important assets are protected. Savvy insurance shoppers know to request regular policy reviews, compare options yearly, and take advantage of complimentary service offerings, all helping to keep premiums down and value up.

Regularly reviewing your policies, especially after major life changes or relocations, ensures that neither your home nor your car is under or over-insured. Features like 24/7 policy service and personal consultations provide not just convenience but allow for continuous optimization—ensuring your insurance grows with you. Community-focused agencies often extend unique local insight, making sure customers are informed about risks specific to their region or lifestyle, and can adjust for the best outcome. In practical terms, this could mean quicker claims, smoother transitions after moving, or extra savings tied to driver safety, home improvement, or customer loyalty.

Simple Strategies: Lowering Your Premium without Lowering Your Protection

Financially savvy homeowners and drivers consistently look to maximize protection while minimizing cost. This refreshing approach relies not just on shopping for lower rates, but on understanding how insurance products actually work for real people. Small, proactive steps can lead to big savings: opt for bundled policies for home and auto, ask about available discounts for safety features, and consider raising your deductible in exchange for lower monthly payments—if your savings can comfortably cover the higher out-of-pocket expense in case of a claim.

For those new to the area or finding Texas rates higher than expected, smooth policy transfers and relocation support make all the difference. Robust agencies distinguish themselves by offering easy, transparent processes and policy reviews designed to uncover hidden savings. Just as important: seeking out agencies that take the time to get to know you, your family, your home, and your vehicle ensures that you won’t be surprised by shortfalls or redundancies in coverage. Importantly, 24-hour service adds a layer of accessibility—you can get answers or file a claim whenever life’s surprises occur.

Community Connection: Insurance Tips Rooted in Local Experience

Knowledgeable agents bring a vital, community-driven perspective to affordable coverage, especially in rapidly growing regions like Dallas/Fort Worth. Local teams not only live and work alongside their customers, but also participate in the community—supporting local initiatives and understanding the unique insurance needs of their neighbors. This real-world engagement is a significant advantage: a team aware of regional weather risks, major events, or relocation trends can preemptively recommend smart, cost-effective adjustments to coverage or discounts.

In addition, agencies offering services in multiple languages and maintaining a friendly, caring approach are uniquely positioned to make insurance both understandable and accessible. Regularly volunteering for local causes or staying active in area networks, agencies like these are built on trust and long-term presence—qualities that matter when you need quick, responsive support. When your insurance advisor is part of your world, you gain insights into timely discounts, coverage tweaks as your lifestyle evolves, and advice you feel good about acting on.

The Value of Free Policy Reviews: Unlocking Hidden Discounts and Custom Coverage

One of the most overlooked resources for policyholders is the complimentary coverage review. Expert agents encourage homeowners and drivers to take advantage of regular, no-pressure reviews, which often reveal straightforward ways to lower costs, improve protection, or both. It’s during these reviews that underutilized discounts come to light—whether for safe driving records, recent home improvements, security upgrades, or simply consolidating policies across home, auto, and renters insurance.

Policy reviews aren’t just paperwork; they’re powerful tools for identifying outdated coverages, outdated valuations, or unnecessary extras. Working with a team that provides transparent, easy-to-understand explanations gives you more control and reduces the regret of finding out after an incident that you could have paid less—or been better covered. Agencies serious about customer care make this process simple, accessible, and tailored, helping local families and individuals confidently protect what matters most without overspending.

Insurance with Heart: A Community-First Approach to Affordable Coverage

When it comes to finding and maintaining affordable home and auto insurance, the difference often lies in the ethos of the agency you choose. Some offices prioritize quick transactions, but community-oriented agencies see themselves as part of their clients’ daily lives. This isn’t just talk—members of the team contribute actively to neighborhood programs, support local business networks, and prioritize accessibility with 24/7 text and call options, along with multi-language service for a diverse clientele.

This people-first philosophy shines in practices like offering free quotes round the clock and streamlining coverage transfers for newcomers, especially for those relocating to the Dallas/Fort Worth area. Teams made up of licensed professionals and local volunteers provide an education-first approach, ensuring you understand not only what your premium pays for, but how best to tailor protection to your real needs—whether it’s auto policies for new drivers, adapting homeowners coverage, or combining multiple services for greater value.

Real People, Real Results: A Success Story in Affordable Insurance

Many searching for affordable home and auto insurance wonder if personalized attention and top-tier service really exist. The lived experiences of policyholders help affirm the value found in choosing the right local agency. One long-term client’s words capture this perfectly—they speak not just to affordability, but to lasting trust and reliable support in every insurance journey.

If there was a 6 star award, Kerri and her team have earned it. We have used Kerri for over 10 years. Always available, always helpful! Highly recommend her and the team for ANY insurance need!

This kind of endorsement is powerful: it reflects the peace of mind that comes from responsive, proactive service and coverage tailored to real needs—exactly what every policyholder deserves. Others seeking affordable home and auto insurance can take heart, knowing that effective support and real savings are possible when service is rooted in care, expertise, and constant availability.

Smart Insurance Choices for Every Budget: Lasting Impact of Being Informed

The journey to affordable home and auto insurance isn’t a one-time decision, but an ongoing process of staying informed, evaluating changing circumstances, and seeking expert input. Agencies focused on the customer’s best interest help cut through complexity, delivering tools and insight for real savings without compromising coverage. As reviewed above, the difference lies in attentive, community-focused service, regular policy reviews, and an ethos of education that empowers clients to make smart, lasting choices for their homes, cars, and lives. Affordable home and auto insurance is tangible and achievable—with the right support, it becomes not just possible, but reliable.

Contact the Experts at Kerri Miene - State Farm Insurance Agent

If you’d like to learn more about how affordable home and auto insurance could benefit your peace of mind and financial security, contact the team at Kerri Miene - State Farm Insurance Agent.

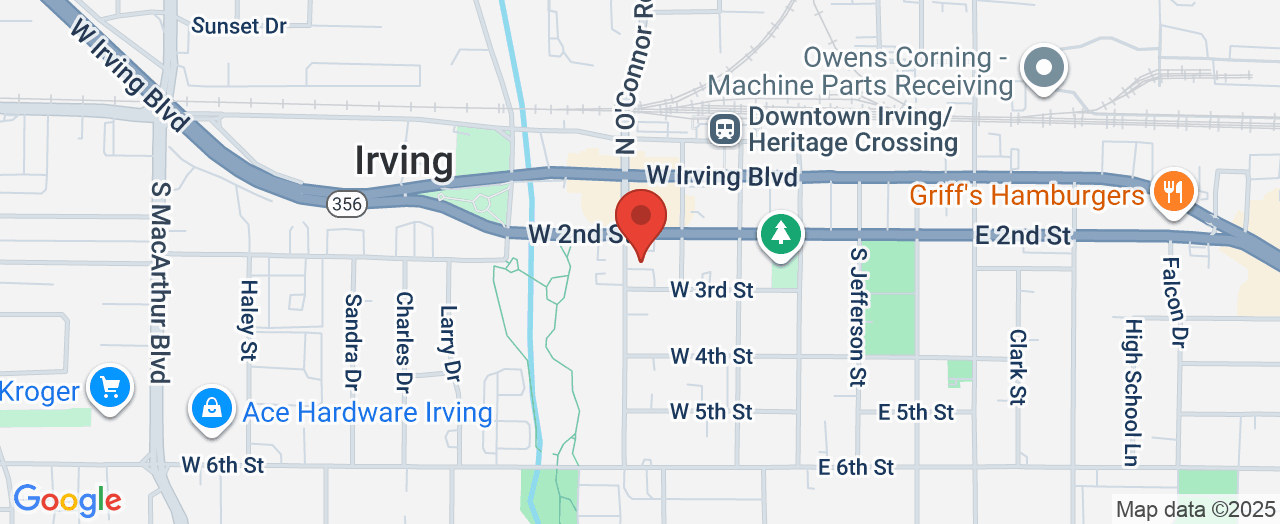

📍 Address: 210 S O Connor Rd, Irving, TX 75060, USA

📞 Phone: +1 972-253-1966

🌐 Website: https://www.kerrimiene.com/

Kerri Miene - State Farm Insurance Agent: Location and Hours of Operation

🕒 Hours of Operation:

📅 Monday: Open 24 hours

📅 Tuesday: Open 24 hours

📅 Wednesday: Open 24 hours

📅 Thursday: Open 24 hours

📅 Friday: Open 24 hours

📅 Saturday: Open 24 hours

📅 Sunday: Open 24 hours

Add Row

Add Row  Add

Add

Write A Comment