Expert Guidance Can Change Everything: Why Choosing an Experienced Financial Advisor Matters

Planning your financial future can feel overwhelming — brimming with questions, fears, and decisions that may shape your family’s legacy for years to come. In today’s world, the landscape of financial options is vast and often confusing; what seems like a minor misstep can have long-term consequences on your savings, investments, and overall sense of security. Experienced financial advisors play a vital role in navigating these decisions, offering clarity and direction at each crucial moment. The question is not just whether you need guidance, but whether you have the right kind of expert supporting you every step of the way.

The value of experienced financial advisors lies in their ability to transform complexity into clarity. They don’t just help you pick a fund or make a budget; rather, they help create a path tailored to your goals, risk tolerance, and the unique circumstances of your life. A trusted advisor provides reassurance that your decisions are informed, your future is secure, and your legacy is protected. By understanding the scope of the advisor’s role and the depth of support they offer, you position yourself to move forward with confidence — taking control rather than feeling lost in a sea of financial noise. The difference between a generic plan and a customized, deeply informed one can be the difference between anxiety and real peace of mind.

The Real Impact of Expert Financial Advice: Understanding the Difference It Makes

Financial advice is much more than just investment recommendations or retirement tips. At its core, working with experienced financial advisors means benefiting from a holistic strategy — one that begins with truly understanding your unique story, continues by empowering you with financial education, and results in ongoing support and adaptation as your needs change. This personal approach removes the guesswork from critical stages like wealth building, estate planning, or navigating retirement withdrawals. Without this level of experience behind you, missed opportunities and costly mistakes can quietly undermine the legacy you’ve worked so hard to build.

For many, the biggest challenge in managing finances isn’t a lack of desire, but a lack of understanding. Questions about when to retire, how to grow wealth, or how to protect assets are not easily answered without comprehensive knowledge. That’s why working with experts who focus on empowering clients, not just managing their money, is so important. Not every advisor will take the time to analyze your situation carefully, recommend personal steps, or educate you for confident decision-making. By recognizing the very real difference a skilled, experienced advisor brings, you avoid the pitfalls of uncertainty and enjoy a smoother, more secure financial journey.

If you’re interested in taking a more proactive approach to your financial planning, Elysium Financial offers a helpful set of Complimentary Guides available for instant download that can help clarify your current situation and identify areas for improvement. This resource is designed to give you a clearer picture of your needs before you even meet with an advisor.

How a Seasoned Advisor’s Approach Delivers Clarity, Confidence, and Peace of Mind

Elysium Financial approaches financial planning with the understanding that every client’s needs are unique. As an expert contributor in this field, their approach is anchored on four key stages to success: understanding your situation in depth, empowering you with relevant education, supporting you throughout the process, and ensuring peace of mind long after the initial plan is set in motion. This roadmap is designed to be seamless and straightforward, helping reduce the anxiety many feel about their financial future. By focusing on these foundational pillars, experienced advisors make sure that you’re never left navigating major life decisions alone.

This process is more than a checklist — it’s a partnership that evolves as your needs do, offering practical solutions and reassurance even through life’s unexpected turns. Education is prioritized so you feel not just guided, but genuinely empowered; every decision is made with the resources and insights necessary to inspire real confidence. This comprehensive support results in deliberate, informed financial actions and minimizes uncertainties. The lasting benefit? A sense of calm about your legacy and investments, knowing an experienced professional has your back every step along the way.

The Process of Personalization: Why Individual Financial Journeys Demand Tailored Expertise

No two financial journeys are alike. Experienced advisors recognize the critical difference between generic advice and the value that a truly personalized plan provides. At the root of effective financial planning lies a deep understanding of a client’s personal story and future goals. Through careful analysis and focused conversations, a seasoned advisor crafts a strategy that aligns precisely with your circumstances — whether you’re looking to protect assets, grow wealth, or plan for a meaningful retirement. This level of bespoke service frequently leads to outcomes that are more aligned with your dreams and able to withstand life’s unexpected events.

By adapting their approach as your needs evolve, a skilled financial advisor ensures that your plan is always relevant — no matter how the economy or your personal life changes. From the very first consultation to future check-ins and adjustments, their support is continuous, providing clarity during transitions such as retirement, inheritance planning, or insurance decisions. This dedicated partnership means you’re far less likely to overlook important details or miss out on opportunities that could impact your financial future.

Empowerment Through Education: Building Confidence in Every Financial Step

A core tenet shared by leading financial advisors is the power of education. Confidence in your financial decisions doesn’t come from being told what to do, but from truly understanding your options and the reasons behind each recommendation. Through clear, accessible educational resources, starting with the Elysium Blog, experienced advisors demystify terms and processes that may otherwise feel confusing or intimidating. Instead of simply handing over control, you become an informed participant in your own financial journey.

This approach means that, whether you’re preparing to retire, managing day-to-day expenses, or mapping out a long-term investment strategy, you have the knowledge to make choices that align with your values and goals. Advisors who make education a priority empower their clients to act with conviction — not just now, but for every financial milestone ahead.

Continued Support Beyond the Plan: Why Lasting Partnerships Matter for Long-Term Security

The value delivered by experienced financial advisors doesn’t end with the creation of a plan. Lasting support is a hallmark of true expertise: periodic reviews, prompt answers to any questions, and proactive recommendations in response to changes in your life or the financial landscape. This ongoing relationship helps clients successfully face complexities such as tax changes, insurance updates, or shifting economic environments.

Having an industry expert by your side through every stage means you are not left to make critical decisions in isolation. The reassurance that someone knowledgeable is available to address your concerns — whether it’s about potential withdrawals, insurance options, or evolving goals — brings invaluable peace of mind.

Elysium Financial’s Distinctive Approach: Putting Clarity and Support at the Center

Within the comprehensive range of financial solutions, Elysium Financial stands out by putting personal support and systematic education at the forefront of its philosophy. The process begins by listening closely to each client’s story, performing in-depth analyses, and then creating an action plan designed to simplify what could otherwise feel like an intimidating journey. Tailored support is not just a slogan — it’s woven into every interaction, ensuring steps are clearly mapped and always relevant to your changing needs.

Industry expertise is never the stopping point at Elysium Financial; clients are empowered with the tools and resources necessary to feel confident long after each meeting ends. This commitment means clients don’t just passively follow instructions — they learn, adapt, and grow alongside their advisor. Seamlessness is the goal, from initial conversations to seeing results and experiencing long-term stability in their financial legacy. Elysium Financial’s advisor-driven approach is designed to foster life-long confidence, demystifying financial planning for individuals and families alike.

Validation in Action: Real Experiences in Financial Planning Success

Successful financial partnerships are best measured by the trust and satisfaction of real people navigating pivotal financial transitions. One powerful example comes from a client who sought clarity with their estate and retirement plans, experiencing firsthand the benefits of focused expertise and prompt, comprehensive advice at every turn.

We were introduced to Jeff at Elysium when we were signing our trusts at a law firm in the same building. We popped in and briefly discussed with him some concerns about our estate for his review and opinion. During our initial meeting, he answered all of our questions. We were especially impressed with the programs he used to determine our retirement needs, projected earnings, and suggested investments for our personal preferences.In the past year, we have been very satisfied with Jeff's quick response to our requests and questions. My husband and I are both retired and preparing to serve a mission for our Church. Jeff has provided helpful advice on potential withdrawals from our accounts, taxes, and insurance while we are away from home. He also referred us to an insurance agent who saved us money on our car and home insurance. It is wonderful having all of our financial needs serviced at one location!

Experiences like these highlight the advantages that come from partnering with an experienced financial advisor; not only is support accessible and personalized, but each client gains confidence through education, timely guidance, and a carefully orchestrated plan. This level of care offers the peace of mind that so many hope for when embarking on their financial journey, and anyone searching for clarity and reassurance would benefit from taking that first, informed step.

Navigating Tomorrow: Why Experienced Financial Advisors Are Essential for Your Peace of Mind

Today’s financial landscape demands more than just surface-level advice or generic roadmaps — it calls for knowledgeable, dedicated experts who can interpret your unique needs and craft actionable, adaptive plans. The true value of experienced financial advisors lies in their ability to transform stress into security, complexity into clarity, and uncertainty into achievable goals. As more individuals look for ways to protect their legacy and empower their decisions, advisors who blend expertise with education and ongoing support are becoming essential contributors to long-term financial well-being. Guided by this approach, Elysium Financial continues to serve as a voice of trust and reliability, helping clients not only prepare for the future but thrive in it.

As you consider your next steps toward financial security, remember that the journey is most successful when guided by expertise and a commitment to your unique goals. Exploring additional resources, such as Elysium Financial’s tailored assessment tools, can provide deeper insight into your current financial standing and help you identify opportunities for growth. By leveraging these advanced strategies and ongoing support, you’ll be better equipped to make informed decisions that safeguard your legacy. Take the initiative to discover how a personalized approach can elevate your financial planning — your future self will thank you for investing in clarity and confidence today. For a more in-depth evaluation, consider reaching out to the experts at Elysium Financial.

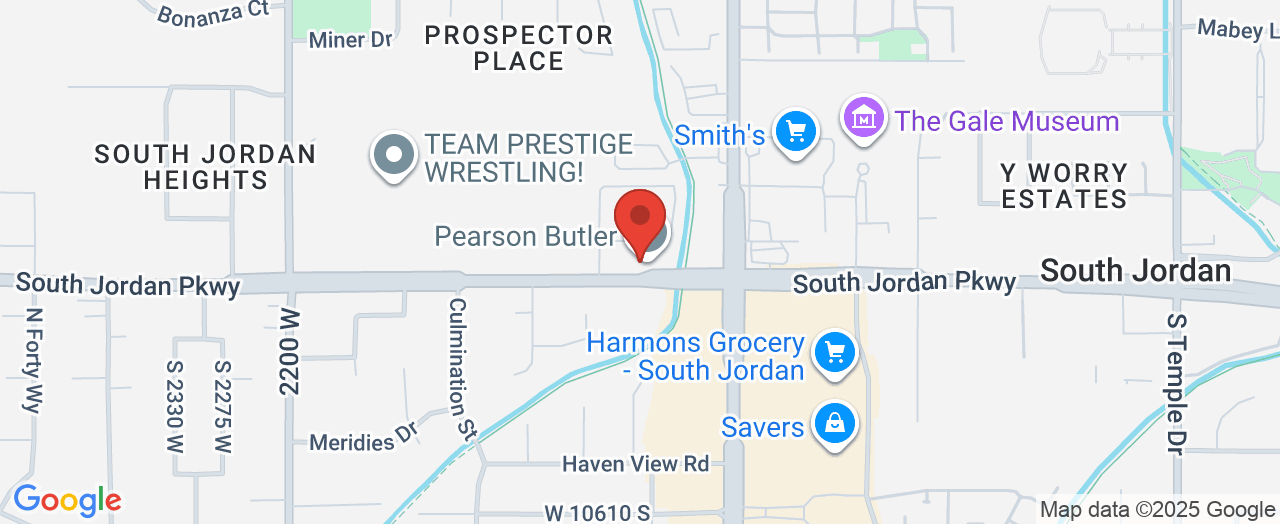

Contact the Experts at Elysium Financial

If you’d like to learn more about how experienced financial advisors could benefit your financial planning, contact the team at Elysium Financial.

📍 Address: 1802 S Jordan Pkwy W Suite 130, South Jordan, UT 84095, USA

📞 Phone: +1 385-276-4716

🌐 Website: https://ut.myelysium.com/financial-services

Elysium Financial Location and Availability

🕒 Hours of Operation:

📅 Monday: 9:00 AM – 5:00 PM

📅 Tuesday: 9:00 AM – 5:00 PM

📅 Wednesday: 9:00 AM – 5:00 PM

📅 Thursday: 9:00 AM – 5:00 PM

📅 Friday: 9:00 AM – 5:00 PM

📅 Saturday: ❌ Closed

📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment