Is Accountanting Holding You Back? Here’s Why Getting It Right Is Critical Now

Ever wondered why some businesses thrive while others constantly struggle to keep their finances in order? In today’s fast-changing world, managing money—whether it’s for your personal life or your business—can feel overwhelming. Financial rules grow more complex by the year. Tax requirements seem to shift every season. Even individuals are impacted, as small mistakes in accountanting lead to penalties, missed growth, and lost peace of mind. It’s no exaggeration to say that how you handle accountanting today can directly decide your future success or stress.

Inadequate tracking, confusing paperwork, and misunderstood obligations can inflict headaches on even the savviest professionals. For business owners and executives, improper accountanting isn’t just a nuisance; it’s a ticking time bomb that can erode trust, shrink profit, and jeopardize your company’s future. Clarity and reliable accountanting are not just technical requirements—they’re essential tools for building a stable foundation, whether you’re planning for growth, compliance, or retirement. If these challenges sound familiar, it’s time to discover the real value of getting it right, and explore actionable solutions designed for your needs.

Understanding Accountanting: Why Precision and Process Matter Now More Than Ever

At its core, accountanting is much more than simply keeping track of numbers. It represents the entire process of recording, managing, and interpreting an individual or organization’s financial world. This domain covers everything from basic bookkeeping to complex tax planning, compliance auditing, and financial reporting. Without reliable accountanting, both individuals and businesses risk losing sight of their true financial position, missing critical deadlines, and potentially facing severe consequences—from tax penalties to business failures.

Neglecting accurate accountanting can also breed uncertainty and anxiety. Imagine trying to make key personal or business decisions, like applying for a loan, investing, or planning for expansion, all without clear and trustworthy figures at your fingertips. Inaccuracies could ripple out into every other part of your finances and life, complicating matters and multiplying stress. For businesses, poor practices mean lost opportunities, ongoing inefficiency, and, in the worst case, lasting financial damage. Understanding the principles and value of true accountanting is the first step to eliminating risk and unlocking real potential.

Why Confidence in Accountanting Changes Everything for You and Your Business

When accountanting is handled by experts, clients reap benefits far beyond simple compliance. For instance, Sotomayor & Associates demonstrates the importance of affordability, ongoing education, and a friendly, tailored approach—all of which lead to tangible results. Accurate and timely accountanting lays the groundwork for sound decision-making, whether you’re a business owner, executive, or independent professional looking to carve out a stable financial future.

Reliable accountanting means better control over cash flow, readiness for audits, and confidence during tax season. It fosters adaptability; clients who understand their numbers respond more quickly to changing economic conditions and market demands. Transparency in reports and guidance prepares businesses to seize funding opportunities, comply with government regulations, and avoid unneeded risks. Ultimately, quality accountanting services transform confusion and stress into clarity and actionable insight, improving comfort, work-life balance, and outcomes for everyone involved.

Modern Accountanting: How Client Portals and Secure Documents Enhance Trust

Trust is essential in financial matters, especially as more transactions and sensitive data move online. Effective accountanting today utilizes secure, digital platforms to protect valuable information and provide clients with peace of mind. Offering a dedicated client portal, for example, gives clients convenient 24/7 access to their critical financial documents and enables secure file transfer, as embraced by established firms. These platforms streamline the entire accountanting process, making collaboration seamless while keeping privacy and security as top priorities.

For both companies and individuals, instant document access removes unnecessary friction and delays, speeds up information sharing, and allows financial strategies to be developed and implemented in real time. Whether tracking expenses, preparing taxes, or communicating with your accountant about key financial moves, this modern, secure infrastructure is now an expected standard in professional accountanting. It’s a smart step toward building lasting professional relationships based on transparency and efficiency.

The Expanding World of Accountanting: From Bookkeeping to International Tax Compliance

Accountanting is no longer limited to tallying transactions and filing annual returns. Today’s landscape demands solutions tailored to a range of specialized needs. For business owners, this includes assistance with government compliance, auditing, and ongoing financial planning—areas that, if neglected, could lead to damaging setbacks. Even individuals may need expert help with international tax compliance and planning as financial lives become more global.

Addressing these evolving demands, professional accountanting firms offer more than just “number crunching.” They provide guidance on Quickbooks and other comprehensive software, help navigate changes in tax law, and stand as proactive advisors in all financial matters. By offering these expanded services, clients gain stability and support to move forward with confidence, even as the financial climate shifts around them.

Why Understanding Your Financial Position is the First Step to Growth

Clarity about one’s financial situation is essential before making any major business or personal decision. Accountanting gives both individuals and organizations the insight they need to evaluate opportunities, weigh risks, and plan for long-term goals. With accurate records and expert guidance, it becomes far easier to apply for loans, attract investments, and make strategic choices that propel growth and security.

Ultimately, embracing reliable accountanting is not just about fulfilling legal requirements—it’s about establishing the trust and discipline necessary to achieve one’s biggest ambitions. Knowledge is power, and in accountanting, this means control over your financial destiny.

Sotomayor & Associates’ Approach: Building Confidence through Affordability, Experience, and a Friendly Touch

At the heart of professional accountanting lies the belief in making financial clarity accessible to everyone. Sotomayor & Associates is licensed in California and is known for offering a full spectrum of services, not only for business owners, but also for executives and independent professionals. The firm’s core philosophy revolves around affordability, professional expertise, and approachability, grounded in years of demonstrated experience in the accounting field.

What sets a knowledgeable firm apart is its commitment to education and personal support through each phase of a client’s journey. Sotomayor & Associates provides tailored solutions—whether for individual tax preparation, business financial planning, or navigating international compliance. Their support extends beyond numbers: with secure client portals and easy file-sharing methods, the experience is structured for both transparency and convenience. This approach fosters long-term trust and demonstrates a real commitment to empowering clients through every financial challenge.

The integration of technology, personalized service, and a mission to demystify accounting for clients marks Sotomayor & Associates as a thought leader in their field. Their dedication to simplifying complex processes without sacrificing depth of knowledge resonates in every client interaction.

What Clients Value Most: Practical Success Stories in Accountanting

Success with accountanting is often best measured in the words of those who have experienced positive results. While all journeys are unique, one need only look to client feedback to understand the power of clear, professional financial support. Whether tackling annual taxes, preparing for business growth, or sorting out international requirements, the confidence gained through skilled guidance is unmistakable.

[No client review available]

With the right guidance and support, individuals and businesses can break free from uncertainty, reduce stress, and finally focus on what matters most—living and working with financial confidence.

Redefining Financial Clarity: Is It Time to Reconsider How You Approach Accountanting?

Accountanting is not just a regulatory requirement—it is the engine behind every effective financial decision you make. With the right partner, the confusion surrounding compliance, taxes, and future planning becomes manageable and clear. As demonstrated by industry leaders who prioritize affordability, trust, and modern solutions, the future of accountanting promises better results for organizations and individuals alike. Knowing where you stand financially is no longer a luxury, but a necessity for success in today’s environment. When expert accountanting support is accessible and encouraged, it enables anyone to chart a path toward security and prosperity.

Contact the Experts at Sotomayor & Associates

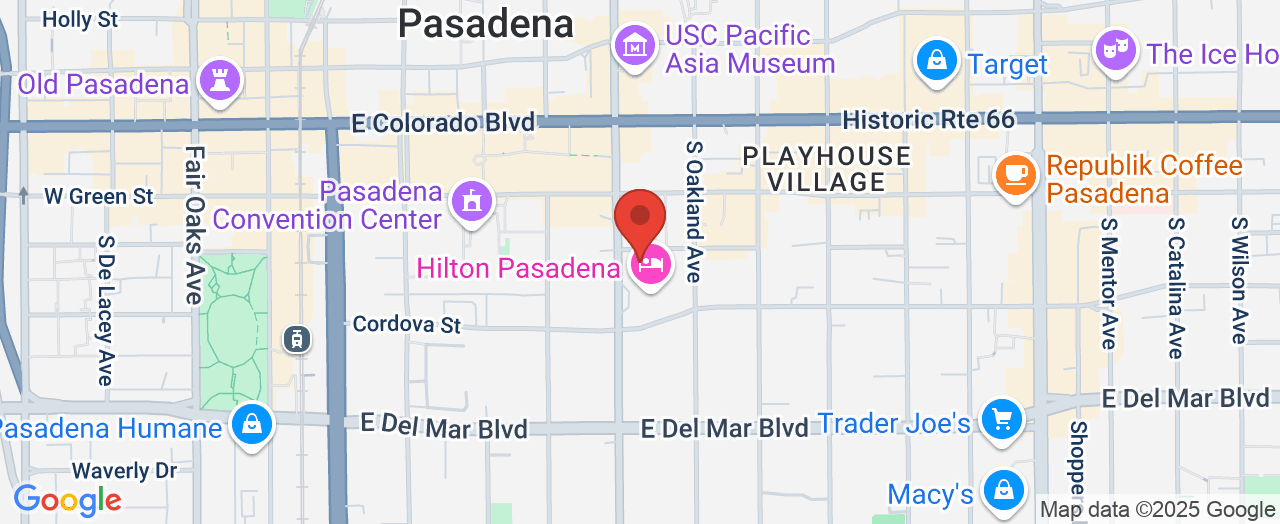

If you’d like to learn more about how accountanting could benefit your financial planning or business goals, contact the team at Sotomayor & Associates. 📍 Address: 150 S Los Robles Ave #450, Pasadena, CA 91101, USA 📞 Phone: +1 626-397-4900 🌐 Website: http://sotomayorcpa.com/

Sotomayor & Associates Location and Availability

🕒 Hours of Operation: 📅 Monday: 9:00 AM – 5:00 PM📅 Tuesday: 9:00 AM – 5:00 PM📅 Wednesday: 9:00 AM – 5:00 PM📅 Thursday: 9:00 AM – 5:00 PM📅 Friday: 9:00 AM – 5:00 PM📅 Saturday: ❌ Closed📅 Sunday: ❌ Closed

Add Row

Add Row  Add

Add

Write A Comment